APRIL 2021 - VANCOUVER REAL ESTATE UPDATE

So another month passes us by and we are in the same environment we have been in for a while now - A hot sellers market. But what’s the difference that April brings to the fold?

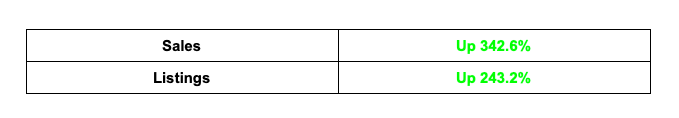

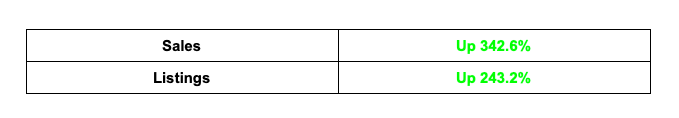

If you’ve been watching, listening or reading our Market Updates over the years, you know we typically focus on year-over-year numbers to determine market volatility. When I say us, that’s not just limited to Mcinnes Marketing, we mean the Real Estate industry too. With that being said, check out the following numbers when comparing April 2020 vs. April 2021:

Now these look like some INSANE level numbers. But in truth, it’s not an accurate reflection of the market. April 2020 was our first full month of Covid lockdown last year. As we started shutting things down mid March initially. So it’s irresponsible in our opinion, to compare the numbers year over year and over inflate the market climate.

Don’t get us wrong, it’s still very busy and very much a sellers market. The sales-to-active listings ratio shows as much (47.9% combined in April 2021). Further to that, if you’re a numbers person, take a look at the table above. Even though these numbers are not an accurate and realistic comparison year over year, you can still see the vast difference in sales numbers vs. listing inventory. This is enough to show demand is very much outweighing supply.

With that being said though, a lot of sellers are very much getting over their heads right now. Jay and I are making the call we are starting to see a slow down in the market. Again, nothing drastic yet, but signs things are slightly starting to lean in a different direction. When seller expectations go through the roof, you hit a peak point. This is further to the blog we put out last week. Put simply, one seller lists his home for $1.6M. In a week, 5 offers come through and it sells for $1.9M subject free. Another seller comes along after seeing that, and thinks they can list the same type of home for $1.9M, get 5 subject free offers and sell for $2.1M.

The reality is it doesn’t work like that. Even when markets are heavily seller focused, it’s not just a ‘pick your price and sell for higher’ strategy. The same thing applies to a buyers market when buyers automatically think it’s $100,000 off the top ‘because it’s a buyers market’. We have these swings and roundabouts regardless of the market.

The problem for sellers is that strategy leaves you on market, and in a market where every house seems to sell in a week, your 45 days on market really stand out and your product sits… Unsold. As price points have increased substantially for these types of homes already, and then you add seller inflated expectations, you break the barrier of unaffordability. This forces the focus to move to other property types, i.e. Stratified homes, or people believing they cannot afford to buy so do not do so. This is the slight turning point we are basing our predictions of the market on. The next 3 to 6 months will be very telling on how true our predictions have come!

Until next week,

Jay Mcinnes

Jay Mcinnes

T: 604.771.4606

jay@mcinnesmarketing.com

Ben Robinson

T: 604.353.8523

ben@mcinnesmarketing.com