Good evening ladies and gentlemen! We hope you are staying safe out there and hopefully excited to see this whole Covid-19 situation come to an end.

Today we bring you the latest in updates for Vancouver Real Estate - April 2020.

Now this update is going to be a bit different. To be completely frank, we’re cutting out the BS and getting down to the real picture here. We’re not feeding into the ‘norm’ because it’s what everyone is talking about, we’re giving you the arguments supported by what we see in the market and the numbers. If you have your set opinion on what’s what and that is not going to change, turn away… well click to another page is probably more accurate to say in a blog. Anyway! Game face…...

The typical format is to discuss listings, sales, sales-to-active ratios etc. Although we will be doing this, this is not a typical market, so the results will not be a typical analysis of where we believe, key word believe, so just bear that in mind. After all, it’s not every year around this time that Covid-19 hits and takes an effect on our market. We would HOPE this is a one off.

So let’s dive right in shall we! As always, let’s start with the sexy stuff …. NUMBERS!

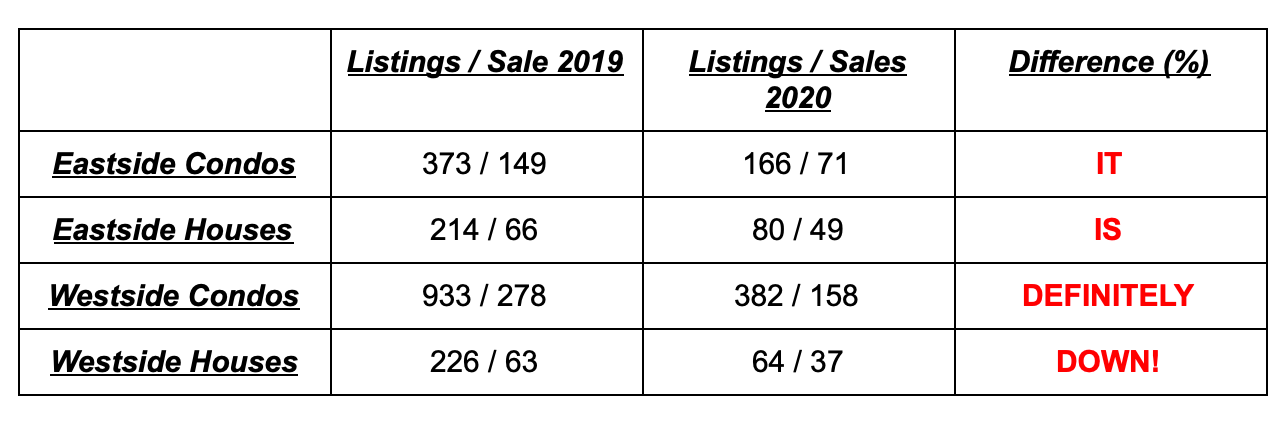

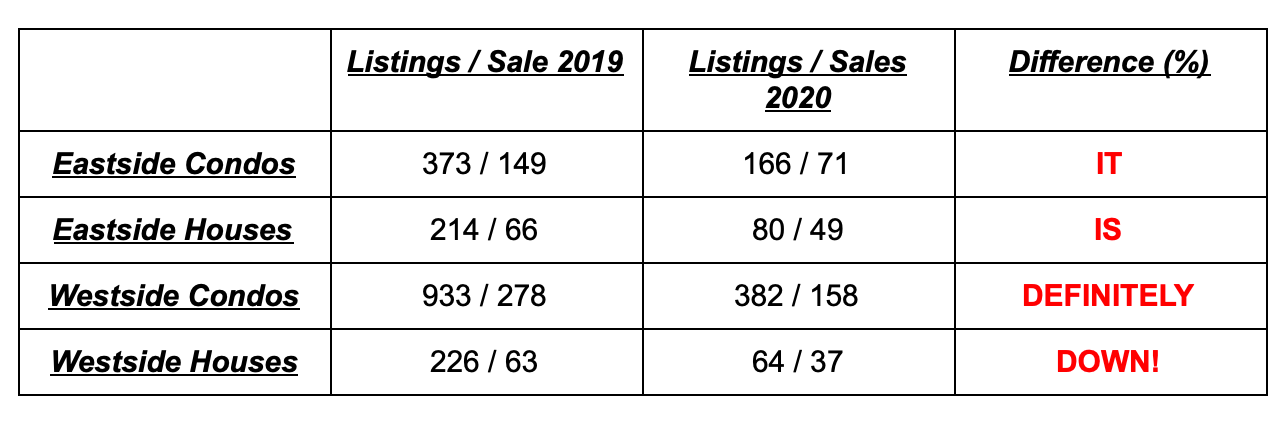

So usually we would put the % difference, but remember how I said this was a different analysis? The market is down from this time last year substantially, but it is not due to the regular real estate cycle, so we cannot use the same comparisons as before.

It’s important to note, prior to the Coronavirus kicking in, we were extremely busy due to a huge increase of demand vs limited supply. Last year in 2019 was the complete opposite, take a look at the amount of available listings in 2019 vs the demand then.

Fast forward to today in 2020, even though Coronavirus is in effect, the supply is not substantially over powering the demand. That’s why although we were 62.7% below the 10-year average for April, we are only sitting at a sales to active listings ratio of 11.8%.

So to be the bearer of bad news to those out there thinking house prices are going to drop by 25% plus, the figures are really not there to back this up. On top of that, the country is starting to proceed forward with a phased opening approach, lifting restrictions and seeing the economy start to pick back up. When this happens more people will be comfortable with open houses and showings. This in our opinion is going to start right back where we left off - A lot of buyer demand, not enough supply.

THEN, you add on top of that, summer is typically a slower period in Vancouver real estate because of vacations and what not, however the tourism sector is still not close to opening, more people will be local and in town, looking to reassure their finances, unable to fly internationally, trying to get back on track with their plans. All of that previous buyer demand we saw up until mid march does not just crash and burn, turning into dust.

Yes there is an argument for the argument of a recession looming after this, a second wave and so on, so forth. However these are all speculative. We’ve heard a recession is coming imminently for the last 18-24 months, possibly more. Until this actually happens, and it’s happened for long enough to affect the housing market, these circumstances do not come into play. The same with a second wave of the virus. Until this happens, everything shuts down all over again for months on end, only THEN do we see the cumulative effect on Vancouver real estate from a second wave.

So that wraps us up for this month's monthly update. As always, we appreciate all our viewers, readers and listeners! Stay well, stay safe and we look forward to being back in front of you all regularly!

Today we bring you the latest in updates for Vancouver Real Estate - April 2020.

Now this update is going to be a bit different. To be completely frank, we’re cutting out the BS and getting down to the real picture here. We’re not feeding into the ‘norm’ because it’s what everyone is talking about, we’re giving you the arguments supported by what we see in the market and the numbers. If you have your set opinion on what’s what and that is not going to change, turn away… well click to another page is probably more accurate to say in a blog. Anyway! Game face…...

The typical format is to discuss listings, sales, sales-to-active ratios etc. Although we will be doing this, this is not a typical market, so the results will not be a typical analysis of where we believe, key word believe, so just bear that in mind. After all, it’s not every year around this time that Covid-19 hits and takes an effect on our market. We would HOPE this is a one off.

So let’s dive right in shall we! As always, let’s start with the sexy stuff …. NUMBERS!

So usually we would put the % difference, but remember how I said this was a different analysis? The market is down from this time last year substantially, but it is not due to the regular real estate cycle, so we cannot use the same comparisons as before.

It’s important to note, prior to the Coronavirus kicking in, we were extremely busy due to a huge increase of demand vs limited supply. Last year in 2019 was the complete opposite, take a look at the amount of available listings in 2019 vs the demand then.

Fast forward to today in 2020, even though Coronavirus is in effect, the supply is not substantially over powering the demand. That’s why although we were 62.7% below the 10-year average for April, we are only sitting at a sales to active listings ratio of 11.8%.

For those that need a refresher, a sales-to-active ratio of 12% is deemed balanced market territory. So although we are seeing record lows since 1982. We are only .2% away from a combined balanced market. To look further into this, Attached properties are sitting at an active ratio of 13.6%, so not even in the buyers market category.

So to be the bearer of bad news to those out there thinking house prices are going to drop by 25% plus, the figures are really not there to back this up. On top of that, the country is starting to proceed forward with a phased opening approach, lifting restrictions and seeing the economy start to pick back up. When this happens more people will be comfortable with open houses and showings. This in our opinion is going to start right back where we left off - A lot of buyer demand, not enough supply.

THEN, you add on top of that, summer is typically a slower period in Vancouver real estate because of vacations and what not, however the tourism sector is still not close to opening, more people will be local and in town, looking to reassure their finances, unable to fly internationally, trying to get back on track with their plans. All of that previous buyer demand we saw up until mid march does not just crash and burn, turning into dust.

Yes there is an argument for the argument of a recession looming after this, a second wave and so on, so forth. However these are all speculative. We’ve heard a recession is coming imminently for the last 18-24 months, possibly more. Until this actually happens, and it’s happened for long enough to affect the housing market, these circumstances do not come into play. The same with a second wave of the virus. Until this happens, everything shuts down all over again for months on end, only THEN do we see the cumulative effect on Vancouver real estate from a second wave.

So that wraps us up for this month's monthly update. As always, we appreciate all our viewers, readers and listeners! Stay well, stay safe and we look forward to being back in front of you all regularly!

Jay Mcinnes

T: 604.771.4606

jay@mcinnesmarketing.com

Ben Robinson

T: 604.353.8523

ben@mcinnesmarketing.com